Immigrant Tax Services in High Demand

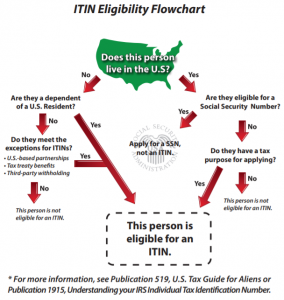

Tax and immigration services are in high demand as immigration reform is on the horizon. All undocumented immigrants living and working in the United States need an Individual Taxpayer Identification Number (ITIN) in order to file and pay their taxes. ITIN holders are eligible for various tax credits which can result in tax refunds, but ITIN holders must file by the official end of tax season with renewed or unexpired ITINs to receive any eligible tax credits. Returns filed with expired ITINs will result in refund delays that require additional work, including an ITIN renewal and possibly an amendment to the original tax return before any refund is issued.

According to the Brookings Institution, there are approximately 10-12 million undocumented immigrants in the US. After several laws enacted, primarily the PATH Act and the TCJA, which greatly impacted tax code as it relates to immigrants, these taxpayers need more assistance than ever to apply for their ITIN, apply or renew ITINs for immigrant family members, and file on time to get the maximum refund possible. As a reminder, ITINs issued before 2013 which were not renewed will have to be formally renewed to be valid for use in filing tax returns or any other use where the ITIN is relevant.

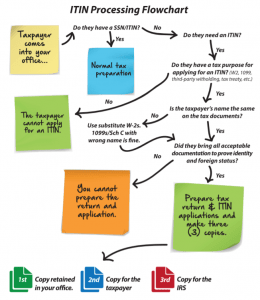

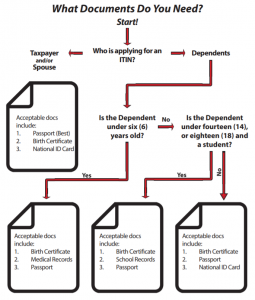

Spouse and dependent ITINs can only be renewed with a valid US tax return. ITIN applications should be attached to a US tax return and mailed to the ITIN Processing Center in Austin. After the ITIN application (or renewal application) is processed, the ITIN Office sends the tax return on for tax processing. Original documents, such as a valid foreign passport, for example, must be included with the application package unless the immigration preparer is a Certifying Acceptance Agent (CAA). Certifying Acceptance Agents go through a 4 month application process of their own to be granted the designation which bequeaths the designee the ability to send copies of the taxpayer’s original documents with the tax return in lieu of the actual original documents. Certifying Acceptance Agents go through IRS tax law training and take a CAA forensic training course focused on identifying fraudulent documents.

Additional information on the process to become a Certifying Acceptance Agent and the fraudulent document forensic course can be found here: https://www.preparertraining.com/product/caa-forensic-training-course/?src=naea

ITIN application and tax preparation support is available to tax professionals in the Federal Direct network. For information on Federal Direct Partnership packages call (866) 357-2052 or visit: https://www.federaldirecttax.com/packages/

Posted: May 18, 2021