IRS Destroys Thousands of Files

The Internal Revenue Service (IRS) has found itself embroiled in a controversy that has sent shockwaves through the financial and legal communities. Reports have surfaced indicating that thousands of crucial files and documents have been destroyed, leaving taxpayers and the IRS itself in a state of dismay and disbelief. In this blog post, we delve into the details of this unprecedented incident, its potential ramifications, and the importance of safeguarding vital information.

The revelation of the destruction of thousands of IRS files has raised serious concerns about the agency’s ability to carry out its fundamental responsibilities effectively. The files in question are not just random paperwork; they contain critical financial records, tax returns destroyed, audit documents, and other sensitive information essential for accurate tax assessment and compliance.

While investigations are still underway to determine the full extent of the incident and the causes behind it, initial reports suggest that the destruction of files might be attributed to a combination of factors, including inadequate record-keeping practices, technical glitches, and, potentially, deliberate actions by individuals with malicious intent. Regardless of the underlying reasons, the outcome is a severe blow to the integrity and credibility of the IRS.

Implications for Taxpayers:

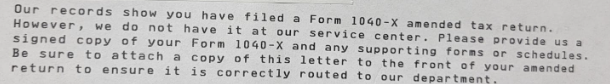

The repercussions of this massive loss of files are far-reaching. For individual taxpayers, it means potential difficulties in retrieving past tax records, which could lead to delayed refunds, disputes over tax liabilities, and complications in resolving tax-related matters. Small businesses and corporations relying on accurate financial information may face audits and penalties due to incomplete or missing documentation.

Furthermore, the lack of accessible historical data may hinder the IRS’s ability to conduct thorough investigations and enforce tax laws effectively. The loss of files could create opportunities for tax evasion, fraud, and other financial irregularities to go undetected, potentially undermining the integrity of the tax system.

To restore public trust and ensure the effective functioning of the IRS, immediate steps need to be taken to rectify the situation. The following measures could be considered:

-

Thorough Investigation: An independent investigation should be conducted to determine the causes behind the file destruction, identify any potential wrongdoing, and hold individuals accountable.

-

Enhanced Record-Keeping Protocols: The IRS must implement stricter record-keeping practices, including redundant backups, regular audits, and improved digital security measures to prevent data loss and unauthorized access.

-

Streamlined Document Retrieval: Efforts should be made to streamline the process of retrieving lost files and records for affected taxpayers. This may involve establishing a dedicated support team, leveraging technology for efficient data retrieval, and providing clear guidance on how to proceed in case of missing documentation.

-

Rebuilding Trust: The IRS must proactively communicate with taxpayers, offering transparency about the situation, acknowledging the gravity of the incident, and outlining steps being taken to prevent similar occurrences in the future.

-

Learning from the Incident: The file destruction incident should serve as a wake-up call for the IRS and other government agencies. It underscores the need for robust data management practices, reliable backup systems, and continuous staff training to ensure the preservation of vital information.

The destruction of thousands of IRS files is an unprecedented event that has cast a shadow over the agency’s credibility and highlighted the importance of safeguarding sensitive information. The incident’s impact on taxpayers and the IRS’s ability to carry out its duties cannot be understated. By conducting a thorough investigation, implementing stricter record-keeping protocols, and taking proactive measures to rebuild trust, the IRS can work towards rectifying the situation and ensuring the protection of vital data in the future.

Posted: July 10, 2023