Is Owning a Tax Franchise Worth it?

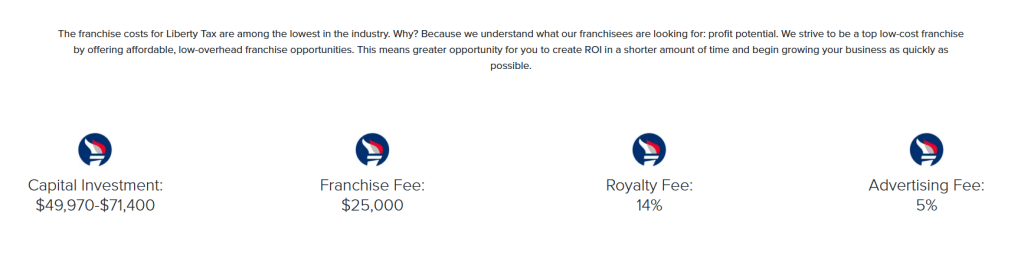

As tax season approaches, and tax adverts begin flooding the radio and tv, you may be wondering about the benefits of owning a tax franchise or whether or not you even need a tax franchise to start a tax preparation business. The truth is that you do not need to buy a tax franchise to start a tax preparation business. There are benefits to buying into a tax franchise, but when you weigh the pros and cons, you may end up talking yourself out of it. The cost to buy a tax franchise varies from franchise to franchise, but let’s take a look at Liberty as a prime example.

After the capital investment, likely into the office set-up, computer workstations, signage, etc. and the franchise fee, you’re already looking at nearly $100,000. This will not include the rent or purchase of the space either so keep that in the back of your mind. Are you going to rent a location or will you buy a building? Tack that onto the start up expenditure total and then consider that no less of 19% of your revenue will be taken for royalty and advertising fees. This pretty standard for any tax franchise, though the actual figures will vary. Many tax franchises will provide in-house financing options which can be one of the benefits to buying a tax franchise.

What are the other benefits to buying a tax franchise?

Other benefits that come with buying into a tax franchise would be that they will provide you with a full business plan covering operations, hiring, training, and they handle national advertising for the brand. Brand recognition is not something that you will need to focus on because you will be (temporarily) buying the goodwill that comes with operating under a nationally recognized brand. Local marketing may still require additional advertising expenditures.

Are the requirements for owning a tax preparation business different than the requirements for owning a tax franchise?

No, the primary difference will be the additional requirements put forth by the franchisor to the franchisee. There will be state franchising licenses necessary as well, but whether you buy a tax franchise, a tax partnership or you simply purchase tax software, the operational requirements for your state and the IRS will remain the same. In order to e-file, you will need an electronic filing identification number (EFIN) which has a lengthy application process and a required background check. You will need a preparer tax identification number (PTIN). Anyone who prepares returns for compensation in your tax office will need their own respective PTIN. If you are in a state with state-specific tax preparer requirements, such as California, those requirements will need to be fulfilled on a yearly basis.

Can I add a tax preparation line of business to my current business without a tax franchise license?

Yes, adding tax preparation to an existing financial service business is not only fairly easy to do but it is also very complimentary. If you are a financial advisor or an insurance agent, offering tax services is a great way to add value to the service that your business provides and maximize your gross revenue. Not only will you be able to speak to your clients knowledgeably about their financial dealings, but you will also be able to speak to them and give sound advice on the tax impacts and perhaps even tax planning. It takes time to build a solid positive reputation as a trusted tax professional but starting with a client base that already has placed their trust in you is a great way to get a head start.

If you are interested in adding a tax preparation business to your existing business, call our office at (866) 357-2052 for more information and a free demographic report on tax offices in your area.

Posted: December 16, 2025